Example Of W2 Transcripts

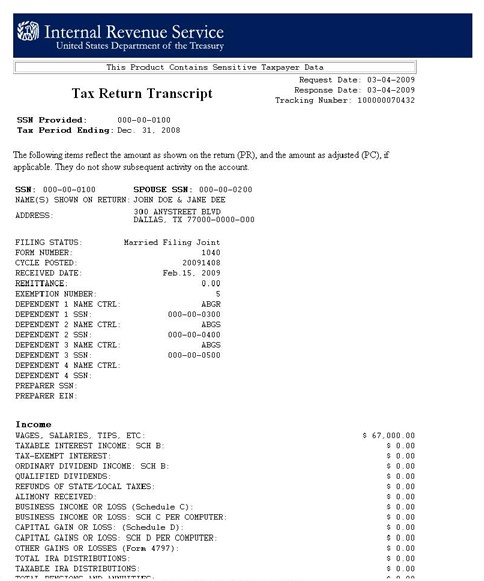

Form W-2 Form 1099 series Form 1098 series or Form 5498 series transcript. A W-2 transcript summarizes the wage information submitted by your employer for example your employment wages retirement contributions and tax withholding.

For address 423 Student Ave Apt1C Bronx NY.

Example of w2 transcripts. However depending on what you need a transcript for you may. 10499 you will enter 4231. If successfully validated tax filers can expect to receive a paper IRS Tax Return Transcript at the address that was.

State or local information is not included with the Form W-2 information. Upcoming component discretionary QC sample using the trend characteristics to target. When requesting business tax transcripts Forms 1120 1120S or 1065 ensure the form is completed in the name of the company and the title of the signor is completed.

10499 you will enter 4231. This resource includes a transcript example from an interview formatted in several different ways. I made these docx and PDF example transcripts for university students educators non-profits journalists filmmakers and.

Leave Line 6 blank and check Box 6a 6b or 6c and 8 checked Option 2. For example 2020 Tax Year data might not be complete until July 2021. Timestamps at regular intervals.

123-45-6789 Tax Period Requested. Lenders may substitute IRS transcripts obtained directly from the IRS with all supporting schedules. 000 Federal Income Tax Withheld.

Check the box for Form W-2 specify which tax year s you need and mail or fax the completed form. Focus reviews on income only and obtain tax transcripts. Wage and income transcripts are available for up to 10 years but current tax year information.

Only one form type 1040 1099 is written on Line 6 with Box 6a 6b or 6c and 8 checked. PO BOX 0000 CITY ST 12345-0000 Employee. De T Expenses Incurred for Qualified Adoptions.

Allow 10 business days from the IRS received date to receive the transcript. Here are the ways to get your 2020 W-2---but you cannot get it until 2021. Wage and Income Transcript - shows data from information returns we receive such as Forms W-2 1099 1098 and Form 5498 IRA Contribution Information.

000000000 ANOTHER EMPLOYER INC. If all Transcript types 1040 or 1099 are needed for Personal Tax Transcript requests choose one of the options below. You can also use Form 4506-T Request for Transcript of Tax Return.

The IRS may be able to provide this transcript information for up to 10 years. Employees Social Security Number. The Wage Income section will provide you with your W-2 1099 andor 1098 data as it was reported to the IRS by employers banks etc.

You might need to phone drop in email andor snail mail an old employer to make sure they know where to send your W-2. Keep in mind the information for the current filing tax year might not be up-to-date until July in the following year. Choose the option of RETURN Transcript.

Tax returns for self-employed borrowers must be copies of the original returns filed with the IRS and include all supporting schedules. Employers Contribution to Simple Account. Available for up to 10 tax years.

00 00 00 00 00 00 00 Designated Roth Contributions under a an. For example W-2 information for 2020 filed in 2021 will likely not be available from the IRS until 2022. Page 2 of 8 0.

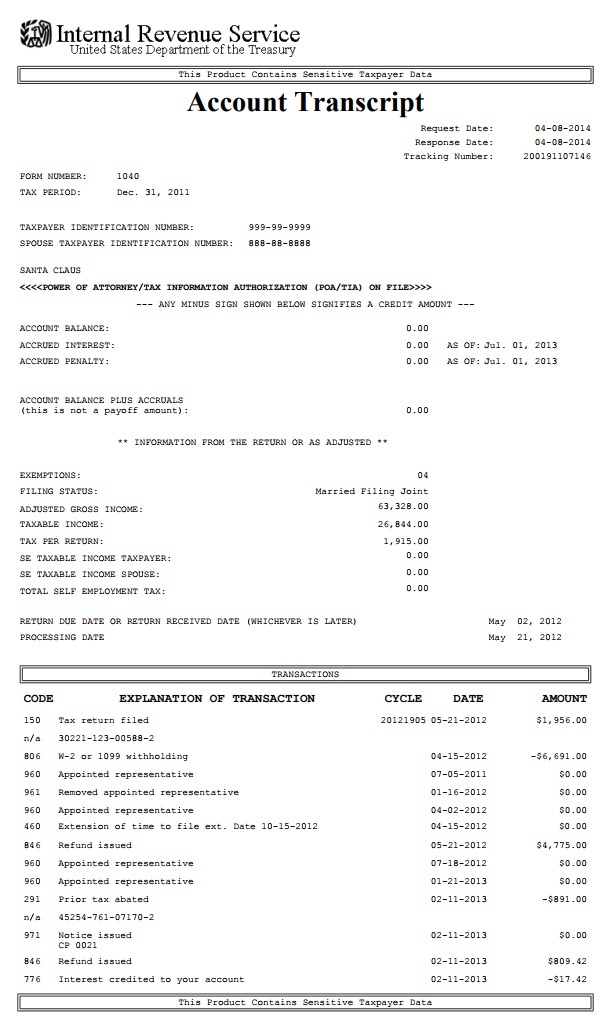

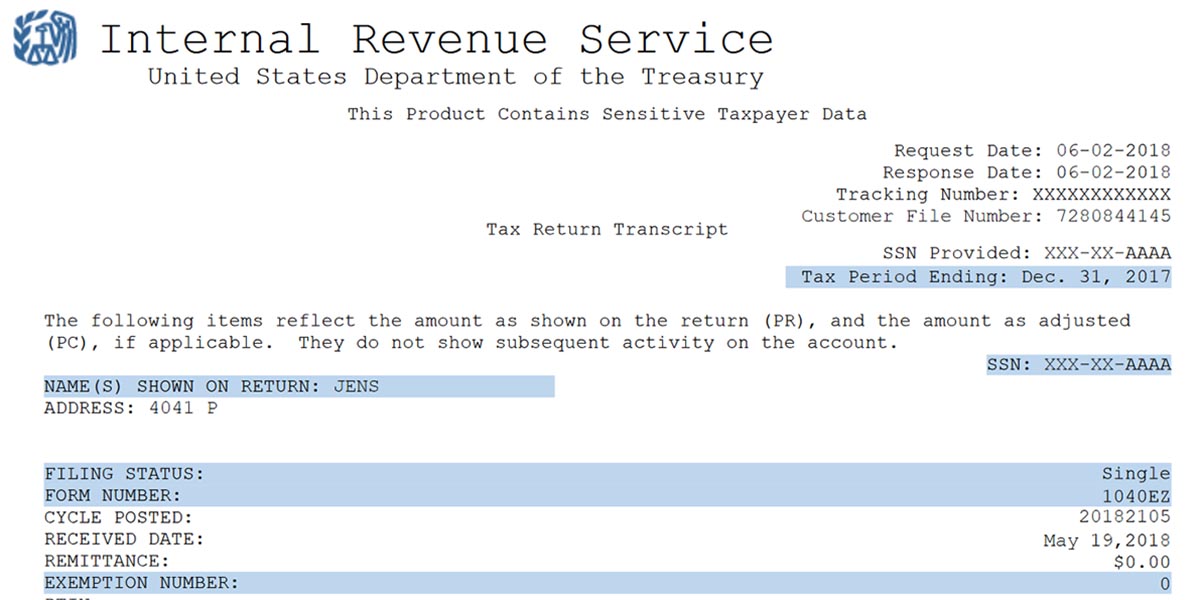

Employer Identification Number EIN. Business Tax Transcript pdf The business return sample is for 1120S but 1065s and other 1120s will have similar information. The IRS can provide a transcript that includes data from these information returns.

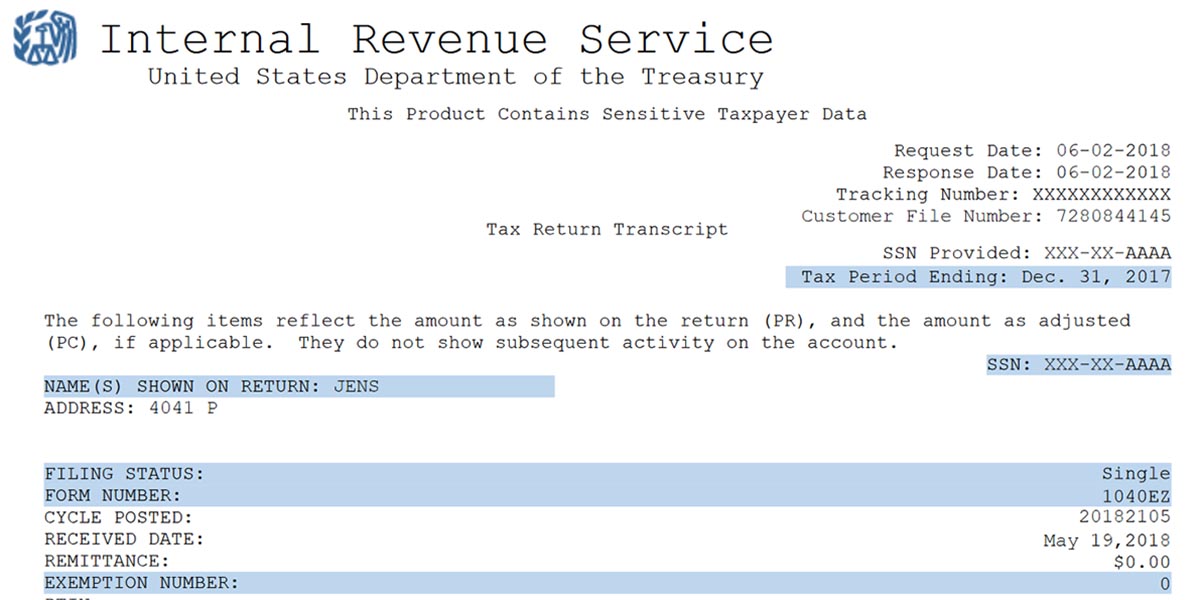

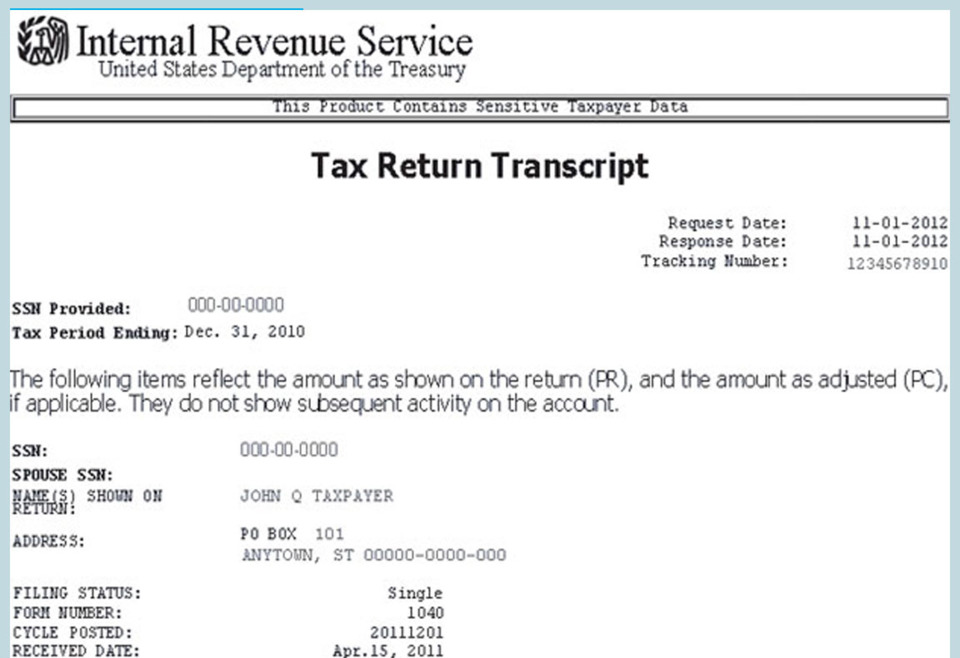

Original document Wages Tips and Other Compensation. Form W -2 Wage and Tax Statement This Product Contains Sensitive Taxpayer Data Wage and Income Transcript W-2SAMPLE Request Date. How to request Personal Tax Transcripts.

Wage and Income Transcript Employer. If successfully validated tax filers can expect to receive a paper IRS Tax Return Transcript at the address that was used in their telephone request within 5 to 10 days from the time the IRS receives the request. For address 423 Student Ave Apt1C Bronx NY.

W-2 Transcript pdf W-2 1099 and all other wage and income transcripts will look similar to this. Employer Identification Number EIN. Some employers allow you to import the W-2 through the software but for security reasons you still need information from the actual W-2 to import it.

Wa e and Income Transcript ode R Employers Contribution to MSA. You will be asked to choose a RETURN TRANSCRIPT or Account Transcript. Lenders may have to obtain these documents from borrowers.

The IRS Wage Income Transcript is a listing of all the information reports that the IRS has received for you. Current tax year information may not be complete until July. This transcript is available for up to 10 prior years using Get Transcript Online or Form 4506-T.

A 1040 transcript is a summary of the items included in your tax return such as your reported income status and dependents. 000-00-0000 FIRST LAST 1 EAST MAIN ST CITY ST 12345-6789 Submission Type. Ensure QC cites a defect when Form 4506-C cant be executed.

Timestamps at speaker or paragraph intervals. You will be asked to choose a Return Transcript or Account Transcript. Upon receipt reconcile transcripts with the income documents used to qualify the borrowers and look for discrepancies.

If you are creating a prior year return from scratch then you can look at the Transcript as the source of information to enter in place of the paper forms. Using the Wage Income Transcript you can see the information that was reported on each W-2 1099 and the other forms. W-2s must clearly identify the applicant and employer.

When your employer sends you a W-2 for the prior year there is a duplicate copy filed with the IRS. The main items of importance that it includes are the W-2s and 1099s that are issued to you. E V Income from exercise cf nonstatutory stock options.

The same goes for the 1099-INT.

Office Of Financial Aid Verification Frequently Asked Questions

How To Read An Irs Account Transcript Refundtalk Com

3 Ways To Get Copies Of Old W 2 Forms Wikihow

3 Ways To Read A Tax Return Transcript Wikihow

4506t Tax Return Verifications Universal Credit

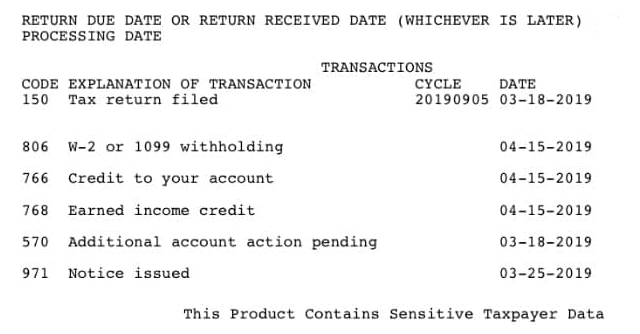

What Does Code 570 Mean On My Account Transcript Refundtalk Com

Https Www Humphreys Edu Wp Content Uploads 2017 12 Tax Return Transcript And Wage Income Request Options 09182017 Pdf

Https New Content Mortgageinsurance Genworth Com Documents Training Course Gnw Best 20practices 20for 20completing 20irs 20form 204506t 20feb 202017 Pdf

Https Www Humphreys Edu Wp Content Uploads 2017 12 Tax Return Transcript And Wage Income Request Options 09182017 Pdf

Tax Transcripts What They Are And Why You Should Care

Frequently Asked Questions One Stop Ndsu

Frequently Asked Questions One Stop Ndsu

Verification Faq Student Financial Services Augsburg University

Wage Tax Statement Form W 2 What Is It Do You Need It

What Is An Irs Wage And Income Transcript And Why You Need One C Brian Streig Cpa

Https Www Hostos Cuny Edu Hostos Media Sdem Financial 20aid How To Request Irs Transcripts Pdf

2020 21 Fafsa Verification Irs Tax Return Transcript Matrix College Aid Services

Wage Tax Statement Form W 2 What Is It Do You Need It

3 Ways To Request A Duplicate W 2 Wikihow

Post a Comment for "Example Of W2 Transcripts"